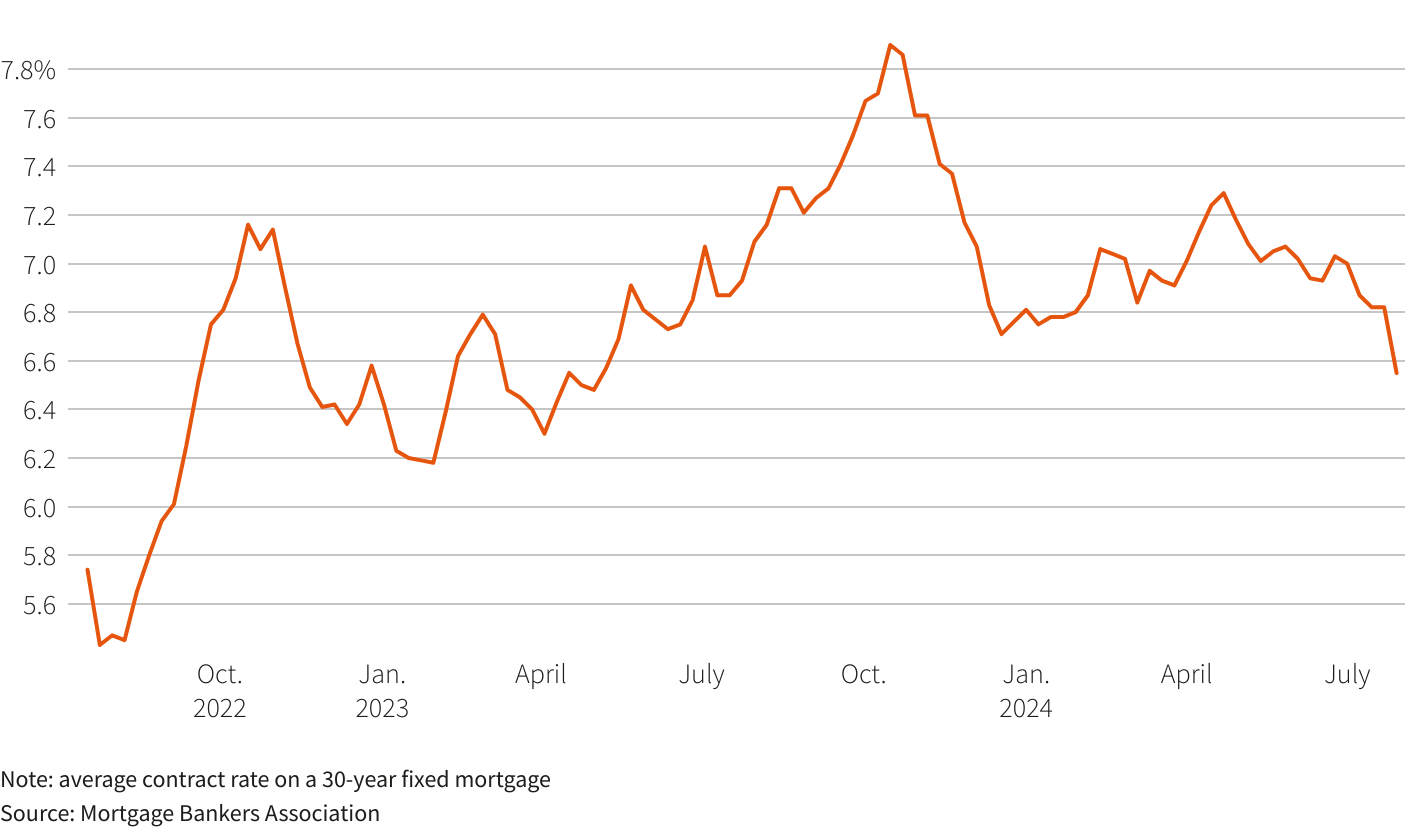

U.S. Mortgage Rates Fall to Lowest Level in Over a Year

Mortgage rates in the U.S. have dropped sharply to the lowest level in 15 months. The average rate on 30-year mortgages, the most common type among homeowners, dropped to 6.47 percent this week, according to a report from government-sponsored mortgage agency, Freddie Mac. Since mortgage rates stood at around 3 percent in 2021, they have steadily climbed in response to the Fed’s increases in its benchmark rate intended to battle inflation.

Freddie Mac’s Chief Economist Sam Khater credited the recent rate drop to a “likely overreaction to a less than favorable employment report and financial market turbulence for an economy that remains on solid footing.” The mortgage rate decline could mean increased purchasing power for prospective homebuyers. It could also translate into more freedom for potential sellers who have felt locked into their existing loans carrying lower rates and could spur them to put their houses on the market. In June, existing-home sales were 5.4 percent lower than June of the prior year. Lower mortgage rates would likely boost the overall volume of home sales.

The decline in mortgage rates could also allow existing homeowners – particularly those who recently obtained mortgages at high rates – to refinance. Freddie Mac reports that the share of mortgage applications reflecting refinancing was the highest in more than two years.

The Fed is widely expected to start cutting interest rates beginning in September. Many investors anticipate an initial rate cut of half a percentage point. While the Fed’s benchmark rate does not directly dictate mortgage rates, a Fed rate is expected to put more downward pressure on mortgage rates. All of this is welcome news for those seeking to buy or sell homes in the U.S.